2025

Path to Net Zero

Policy Landscape in the UK

Key Policies / Bills for Net Zero 2030 Goals

03 | Key Policies / Bills for Net Zero 2030 Goals

Contents

Browse Key Policies / Bills for Net Zero 2030 Goals

Creation of National Wealth Fund (“NWF”): Driving the UK’s 2030 Net Zero Investment Agenda

Building on the UK Infrastructure Bank (“UKIB”)

-

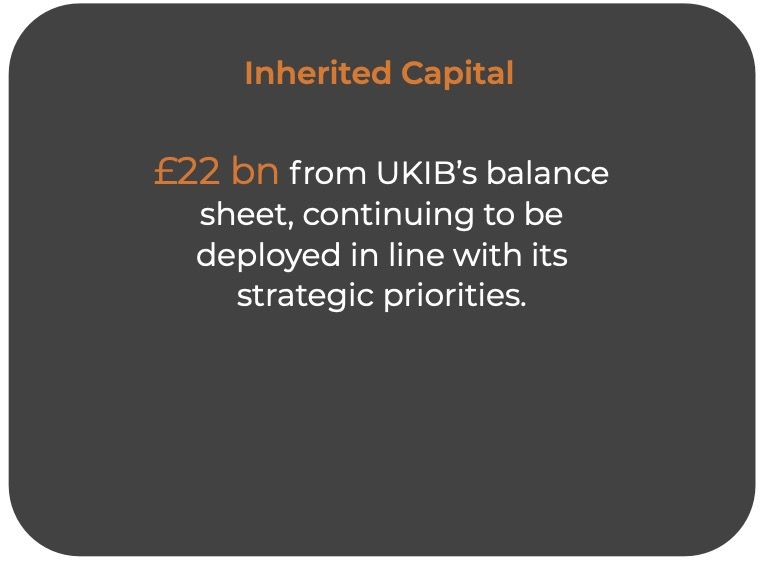

The NWF was launched in July 2024. It builds on the UKIB’s foundation, consolidating its expertise, governance, and £22 bn investment capacity into a single publicly backed institution, rather than creating a new one from scratch.

-

This ensured continuity in delivering strategic infrastructure projects while broadening its mandate beyond traditional infrastructure to embrace a full spectrum of green industrial priorities.

Rationale for Creation: To Drive the UK’s Green Industrial Strategy

-

The NWF was established as a central pillar of the UK’s green industrial strategy, tasked with unlocking private investment at scale to meet the UK’s 2030 net zero electricity goals and drive long-term economic resilience.

-

Its mission is to act as a market-maker — intervening where private finance is insufficient and accelerating projects that deliver both climate and economic returns.

-

It will also work with local authorities and devolved administrations to align investments with regional industrial strategies, ensuring that green growth is spread across the UK and anchored in local supply chains.

Consolidating Capital and Expanding Investment Power

Targeting High-Impact Sectors

Green Ports

Gigafactories

Green Steel

Carbon Capture and Storage (CCS)

Green Hydrogen

Mobilising Private Capital at Scale

-

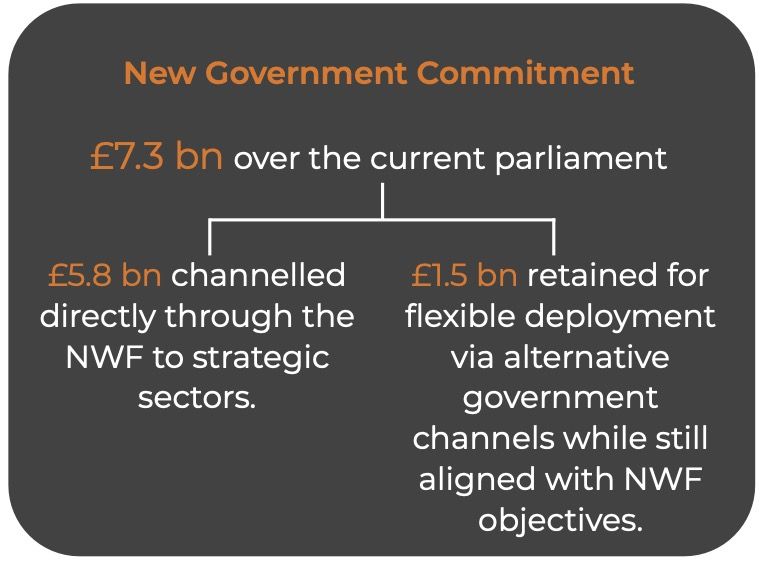

The NWF’s investment model is based on a 1:3 leverage ratio — for every £1 of public investment, it aims to attract £3 of private capital, translating its existing resources into at least £70 bn in private sector mobilisation.

-

Independent analysis suggests the potential is far greater if the NWF is granted enhanced borrowing or liability-issuing powers. Under such a model, the planned £7.3 bn government funding could mobilize over £180 bn — or around £228 bn when including the balance sheets of UKIB and the British Business Bank (“BBB”).

-

BBB’s role within the NWF ecosystem is complementary: by financing clean-tech Small and Medium Enterprises (“SME”) and supply-chain businesses, it can amplify the impact of NWF-led anchor investments.