2025

Path to Net Zero

Policy Landscape in the UK

Key Policies / Bills for Net Zero 2030 Goals

03 | Key Policies / Bills for Net Zero 2030 Goals

Contents

Browse Key Policies / Bills for Net Zero 2030 Goals

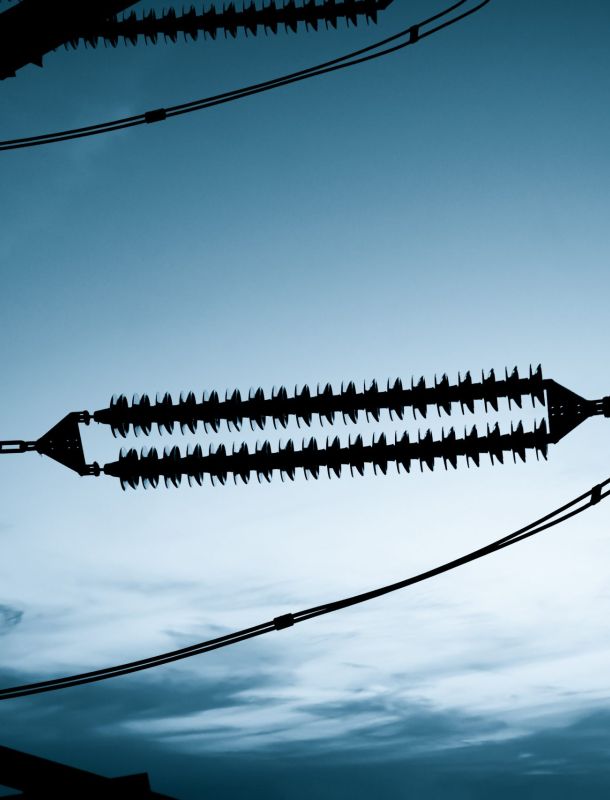

Tackling Grid Bottlenecks to Unlock Clean Energy Growth

The Challenge: Grid Connectivity Backlogs Hindering Net Zero Progress

-

The UK’s progress towards its clean energy and net-zero goals is being significantly hindered by widespread grid connection delays and bottlenecks. By the end of March 2025, grid connection backlogs had soared to a staggering 771 GW, with many renewable projects facing connection delays extending into the late 2020s and beyond.

-

This backlog reflects the limitations of an outdated grid access model and an underprepared transmission network struggling to keep pace with burgeoning clean energy projects. Addressing this issue is critical to unlocking the government’s 2030 clean energy ambitions.

Institutional Reform: NESO as an Independent System Operator and Planner

-

In response to these challenges, the UK government took a decisive step by creating the National Energy System Operator (NESO) on 1 October 2024, replacing the former National Grid Electricity System Operator (ESO).

-

Established under the Energy Act 2023 with a £630 million investment, NESO is a publicly owned, independent entity created to resolve conflicts of interest in the previous system, where the ESO both operated the electricity system and owned transmission assets.

-

As the Independent System Operator and Planner (ISOP), NESO now manages both electricity and gas networks, leads long-term strategic network planning, and provides impartial, whole-system advice to government and regulators, which are foundations crucial to accelerating the UK’s clean energy transition.

NESO’s Mandate: Driving Strategic Energy System Planning and Coordination

-

NESO is tasked with balancing electricity supply and demand, developing the Strategic Spatial Energy Plan (SSEP), and coordinating closely with key bodies such as Great British Energy (GBE) to fast-track renewables and storage deployment.

-

As the UK’s central energy system planner, NESO plays a key role in shaping government strategy and guiding investment decisions in alignment with the Clean Power 2030 framework.

Modernising Grid Access: From ‘First Come, First Served’ to ‘First Ready, First Needed, First Connected’

-

A cornerstone of NESO’s reform agenda is the introduction of Target Model Option 4+ (TMO4+), a radical overhaul of the grid connection process approved by Ofgem in April 2025.

-

TMO4+ replaces the dysfunctional “first come, first served” queue, notorious for locking projects in waitlists up to 15 years long, with a two-stage gate-based system that prioritizes project readiness and strategic alignment.

Key Grid Connection Reforms and Their Implications

| Reform Name | Scope & Details | Objectives & Implications |

|---|---|---|

| Application of Reforms | Applies to transmission-connected projects and distribution projects requiring Transmission Investment Assessment (“TIA”) or Modification Applications (“ModApps”). Excludes small, embedded generators below thresholds and demand-only projects without transmission impact. | Focuses efforts on high-impact projects for efficient transmission capacity allocation; reduces burden on small generators to support distributed clean energy growth. |

| Transition to ‘First Ready, First Needed, First Connected’ Model | Replaces “first come, first served” with a gate-based system prioritizing projects meeting readiness and strategic criteria. | Prioritizes shovel-ready projects critical to grid stability, cuts waiting times, and streamlines connection to accelerate clean energy infrastructure. |

| Gate-Based Queue System | Introduces Gate 1 (indicative offers), Gate 2 (definitive offers based on readiness / strategic alignment), and Gate 2 to Whole Queue (“G2WQ”) reassessment of legacy projects. | Ensures only viable, aligned projects progress; removes speculative applications; enforces milestones to reduce queue congestion and boost investor confidence. |

| Pausing New Grid Applications | Temporary suspension of new grid applications (from 29 Jan 2025), with exceptions for critical and demand-only projects. | Allows focused reform implementation and queue reassessment without system overload; controls speculative project entry during transition. |

Grid Connectivity Investments to Support Capacity Growth

-

Addressing physical grid constraints, the UK’s three transmission owners—National Grid (£35 billion), Scottish and Southern Electricity Networks (SSEN) Transmission (£22.3 billion), and Scottish Power Energy Networks (£10.6 billion)—are set to invest nearly £68 billion from 2026 to 2031.

-

These investments will fund major upgrades to overhead lines, Accelerated Strategic Transmission Investment (ASTI) projects, and new connections, targeting a doubling of network capacity and a significant reduction in connection delays.

-

To finance these multibillion-pound plans, transmission owners are employing equity raises, asset sales, and debt instruments. For example, National Grid is supporting its programme through a £6.8 billion rights issue, divestments such as the Grain LNG terminal, and debt refinancing.

-

Ofgem’s £4 billion Advanced Procurement Mechanism (APM) enables transmission owners to pre-order critical equipment ahead of project approvals, reducing supply chain delays and expediting grid upgrades.

Investment Potential

-

Guided by NESO’s recommendations, the government’s 2030 Action Plan calls for over £40 billion in annual energy infrastructure investment over the next five years, approximately £30 billion for low-carbon generation and £10 billion for transmission upgrades, primarily sourced from private investment.

-

These investments, channelled through transmission owners, are critical to accelerating grid connections, meeting rising electricity demand, and supporting the UK’s transition to a decentralized, renewable-based energy system. These upgrades will enable more efficient integration of clean energy into the grid.

-

Moreover, this approach is expected to stimulate growth in high-demand sectors such as electric vehicle charging infrastructure and data centres, while avoiding unnecessary expansion of grid infrastructure. By optimizing investment and planning, the strategy is projected to deliver consumer savings of approximately £5 billion.