2025

European Gigafactory Market

Outlook

04 | Outlook

Europe’s EV Market Surges in 2025, Powering a Battery Manufacturing Revival

While EV sales stagnated in 2024, triggering delays and cancellations, the sharp rebound in 2025 demonstrates that this slowdown was cyclical rather than structural. The recovery has restored confidence in long-term demand and underpins renewed momentum for gigafactory investments. Last year, EV market share plateaued at approximately 20%, primarily due to reduced government subsidies and stable EU CO₂ regulations. These factors raised concerns about long- term demand, with some markets even recording year-on-year declines. However, 2025 has marked a clear turnaround. The European EV market expanded by 27% in the first five months of the year, with 1.6 million units sold, signalling a strong resurgence in consumer demand and market momentum.

This growth reflects broader consumer acceptance and an expanding pipeline of EV models. Policy support also plays a key role. Germany, for instance, recently introduced a new EV incentive package that includes special depreciation allowances and tax relief for corporate fleets. This initiative is expected to significantly boost demand since corporate purchases account for more than half of new vehicle sales.

Importantly, the International Energy Agency (“IEA”) projects that this renewed momentum in EV adoption will be sustained. According to its latest forecasts, EV sales in Europe are expected to continue rising steadily, reaching approximately 60% market share by 2030. This long-term growth trajectory provides a solid foundation for scaling up Europe’s battery manufacturing sector.

As EV demand increases, so will the need for secure, sustainable, and locally produced battery supply chains. The current market rebound, therefore, not only reinforces the investment case for European gigafactories but also plays a critical role in advancing the continent’s clean technology sovereignty.

The Need to Commercialize New Battery Technologies for Differentiation

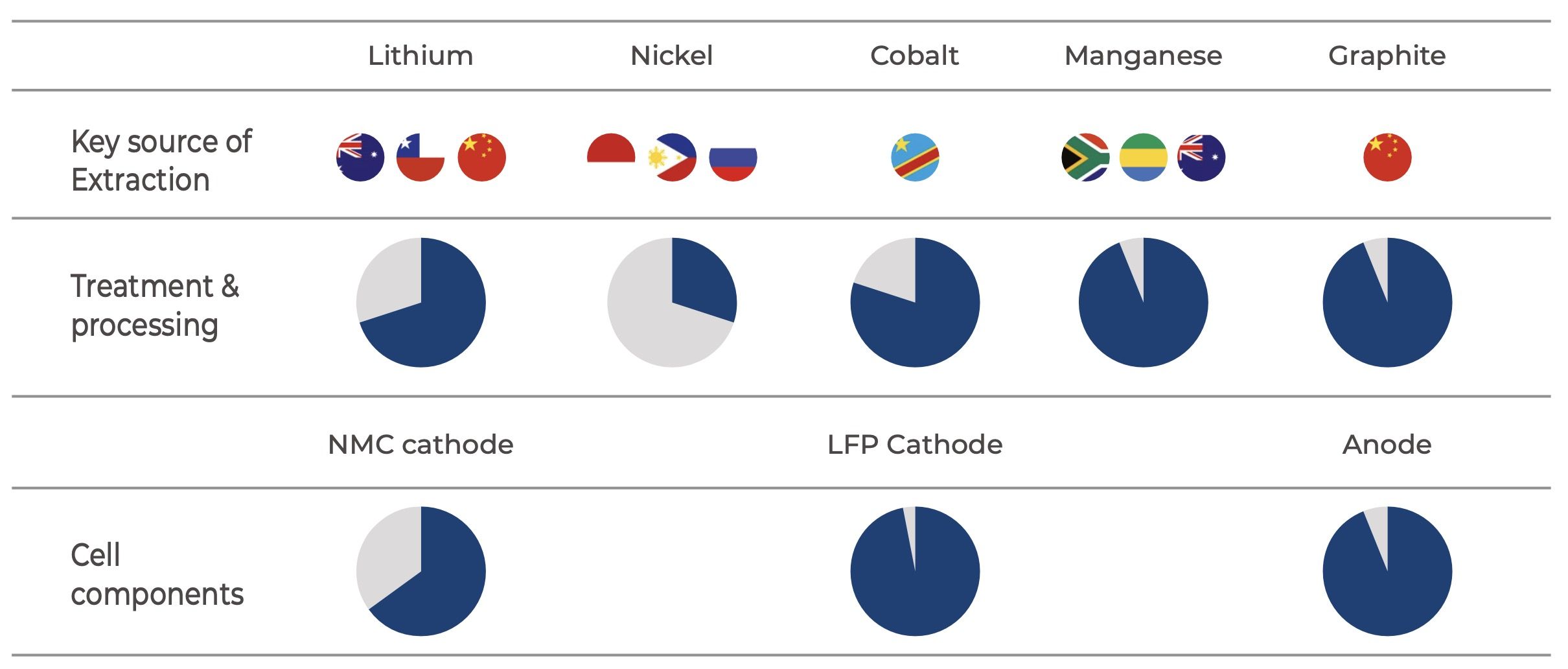

China’s Strangledhold over Materials in the Battery-making Supply Chain

China’s share of raw-material processing and battery-cell components shown in dark blue

LFP Batteries: Poised for a Growth in the EU

Indicative List of Planned Gigafactories on New Technologies in Europe

| Plant Location | Company | Project Cost | Technology | Target Capacity (GWh/Year) |

|---|---|---|---|---|

| Dunkirk, France | ProLogium | €5.2 billion | Solid-state | 48 by 2032 |

| Alsace, France | Blue Solutions | €2.2 billion | Solid-state | 25 by 2030 |

| Minano, Spain | Basquevolt | €0.7 billion | Solid-state | 10 by 2027 |

| Amiens, France | Tiamat | €0.5 billion | Sodium-ion | 5 by 2030 |

The US Government’s Tariff Position and Implications

As Europe pushes to commercialize next- generation battery technologies, global trade dynamics are rapidly reshaping the competitive landscape. The US government’s newly implemented tariff policy marks a pivotal shift in global trade and industrial strategy. Central to this transformation is the introduction of a broad 10% import tax, accompanied by reciprocal tariffs on goods from other nations. These tariffs include a 30% levy on Chinese imports, 15% on goods from Japan, Korea, and the EU. However, automobiles and auto parts will continue to face higher tariffs (up to 27.5%) until the EU enacts its own tariff reductions on US goods. This policy signals a strong emphasis on US economic priorities, particularly in the energy and technology sectors.

In response to these changes, the EU faces growing pressure to strengthen its cleantech sector, navigating the uncertainties posed by new US trade policies and potential tariff risks. These developments, coupled with the possibility of rollbacks to the IRA, may prompt European firms to reassess their plans to expand into the US market. To remain competitive and reduce strategic dependencies, the EU must act swiftly to align its policy instruments with the goal of building a robust business case for the next generation of clean industries. Central to this effort is the successful implementation of the Clean Industrial Deal, which is essential for stimulating demand for cleantech and unlocking public de-risking mechanisms that can mobilize investment from Europe’s €38 trillion private capital market.

Clear demand signals and effective de-risking strategies are urgently needed to strengthen industrial resilience. With strong political support, the EU is at a pivotal moment, presented with a unique opportunity to convert policy ambition into meaningful economic impact.

Cost and Talent Constraints Challenge Europe’s Battery Ambitions

Policy Response: Strengthened Commitment Despite Setbacks

Despite challenging market conditions and sector-wide setbacks, European governments and institutions have reaffirmed their commitment to developing a robust domestic battery industry, demonstrating resilience and strategic focus rather than retreat. While private investors remain cautious, this has prompted the EU and national governments to intervene with unprecedented policy measures and financial support. A new wave of subsidies, loan guarantees, and regulatory reforms is strategically designed to attract private capital and safeguard the momentum of Europe’s gigafactory development pipeline.

The European Commission and the EIB first acted in late 2024 with a €3 billion emergency support package aimed at stabilising the European battery value chain. This included the €1 billion IF24 Battery programme to accelerate domestic cell production, a €200 million InvestEU loan guarantee top-up to help start-ups scale, and €1.8 billion in direct EIB investments across recycling, charging infrastructure, and advanced materials. These measures were conceived as rapid interventions to prevent project delays and counter competitive pressures from the US and China.

In early 2025, the European Commission introduced the Battery Booster package, designed to close the cost gap between EU- made battery cells and imports. Backed by €1.8 billion from the Innovation Fund, the package specifically targeted gigafactories and component makers to ensure that ongoing investments could move forward despite high energy prices and cost inflation

By focusing on near-term competitiveness, the Battery Booster helped de-risk projects already under development, anchoring industrial capacity in Europe.

This policy momentum culminated in March 2025 with the release of the Action Plan for the European automotive sector, which consolidated measures into a forward-looking strategy for long-term competitiveness. Within the plan, the European Commission identified over €3.8 billion in dedicated battery-related initiatives, including: €350 million for next-generation R&D via BATT4EU, €1 billion from Horizon Europe for connected and autonomous vehicles and batteries, €570 million from the Alternative Fuels Infrastructure Facility to improve repairability and accelerate charging rollout, the €1.8 billion Battery Booster package (incorporated into the wider framework), and €90 million via the Pact for Skills Fund to upskill the workforce. Taken together, these actions illustrate a sequenced approach—short-term stabilisation in late 2024, targeted cost- competitiveness in early 2025, and a long- term industrial transformation strategy from March 2025 onwards.

By integrating emergency funding, competitiveness initiatives, and structural reforms, the EU has established a foundation that enables Europe’s gigafactory pipeline to progress from announcements to active construction and scaling. This approach reinforces Europe’s ambition to build a globally competitive, resilient, and sustainable battery ecosystem.

National governments have also intensified efforts. Germany is now collaborating with US battery company Lyten, which has acquired the Northvolt Drei assets—including the Heide gigafactory project—and is working with regional and federal authorities to move forward with the 15GWh facility. In the UK, a £1 billion package supports AESC’s Sunderland gigafactory, combining guarantees and direct grants. France provided €48 million for AESC facility in Douai, while Spain raised support for major battery initiatives—awarding €133 million to Stellantis and increasing Volkswagen’s PowerCo funding from €98 million to €152 million.

While financial and execution risks persist, and global competition intensifies, policymakers are becoming more selective— prioritising projects with solid fundamentals and diversified inputs. Still, the outlook remains positive. Europe is recalibrating its battery strategy with a sharper focus on innovation, resilience, and industrial policy. Recent setbacks have underscored the need for smarter investment and EU institutions remain committed to building a robust, sustainable battery sector.

Scaling Amid Structural Constraints

Against this backdrop, Europe’s battery production capacity continues to expand. Existing facilities have reached over 300GWh in annual capacity, largely developed through partnerships with Asian manufacturers. Projects under construction are expected to add another 500GWh and long-term plans could push capacity to 1,500GWh by 2030. This sustained growth underscores the resilience of the industry. While individual projects may face obstacles, the broader momentum reflects Europe’s commitment to scaling production in line with growing demand for EVs and energy storage..

However, structural financing constraints present a growing risk. Tight fiscal rules are limiting Europe’s ability to make meaningful public investments in cleantech, threatening the scalability and global competitiveness of its battery ecosystem. According to T&E, at least €50 billion in public funding—via grants, loans, and risk-sharing instruments— is required by 2030 to build a viable and competitive battery value chain. Establishing a dedicated green investment fund and reforming fiscal policy frameworks will be critical to avoiding long-term strategic dependence and securing Europe’s position in the global battery race..

Indicative List of Near-term Scheduled Gigafactory Projects in Europe

| Plant Location | Company | Project Cost | Target Capacity (GWh/Year) |

|---|---|---|---|

| Dunkirk, France | Verkor | €3 billion | 16 by 2025 50 by 2030 |

| Salzgitter, Germany | Volkswagen | €2 billion | 20 by 2025 |

| Teverola, Italy | FAAM | €0.5 billion | 8 by 2025 |

| Arendal, Norway | Morrow | €0.5 billion | 1 by 202543 by 2029 |

| Navalmoral de la Mata, Spain | AESC | €1 billion (Phase 1) | 30 by 2026 |

| Douai, France | AESC | €1.3 billion (Phase 1) | 9 by 202524 to 30 by 203040 in future |

| Valencia, Spain | Volkswagen/PowerCo | €3 billion (Phase 1)€4.5 billion (Phase 2) | 40 by 202660 in future |

| Zaragoza, Spain | Stellantis-CATL | €4.1 billion | 50 by 2026 |

| Debrecen, Hungary | CATL | €7.3 billion | 40 by 2025100 in future |

| Debrecen, Hungary | EVE Energy | €1 billion | 28 by 2027 |

| Sines, Portugal | CALB | €2 billion | 15 by 2027 |

| Bridgewater, UK | Tata Group | €4.6 billion | 40 by 2026 |

| Orkland, Norway | Elinor Batteries | €1 billion | 10 by 202640 by 2030 |

| Subotica, Serbia | ElevenEs | €1 billion | 1 by 2027 (Initial of Phase-1)8 in future(End of Phase 1)49 by 2031 |