2025

European Gigafactory Market

Current Developments in the Market

03 | Current Developments in the Market

Funding / Investments and Investor Perceptions

Shifting Away from Heavy Reliance on VC Funding

The experience of recent high-profile setbacks in Europe’s battery sector highlights the inherent risks of relying too heavily on venture capital (“VC”) to fund capital-intensive gigafactory projects. VC funding models, which are typically geared toward rapid scaling and short-term returns, may not align well with the extended investment timelines, operational complexities, and substantial upfront capital requirements associated with establishing large-scale battery manufacturing facilities.

For many early-stage gigafactory ventures, this mismatch has underscored the need to diversify funding strategies. Rather than leaning predominantly on VC, new entrants are increasingly expected to look towards industrial partnerships, government-backed financing, and long-term strategic investors with the capacity and patience to support multi-year buildouts. Such a shift would allow these companies to focus on disciplined execution and sustainable growth, while positioning Europe’s battery ecosystem on a firmer footing in the global race for capacity.

This reassessment comes at a time when broader market conditions are adding further pressure to traditional funding models. 2024 was a particularly challenging year for cleantech investment in the EU, as it marked the first decline in both investment volume and deal activity in over a decade. VC investment in EU cleantech fell to €8.8 billion, down from €11.6 billion in 2023. The number of deals also dropped to 665, compared to a peak of 721 the previous year. While Series B rounds held steady, activity in Seed, Series A, and Growth Equity stages saw declines. The EU’s share of global cleantech venture and growth investment held relatively steady, dipping slightly from 23% in 2023 to 22% in 2024, yet it still lags well behind the US – 32% in 2023 and 42% in 2024.

In the first half of 2025, this cautious sentiment persisted, with Q1 marking one of the weakest quarters since 2020, with €1.9 billion invested in European cleantech VC as investors held back from early-stage bets, and Q2 showing only a modest rebound to around €2.5 billion. The recovery was concentrated in larger late-stage deals, as ticket sizes increased while seed and Series A activity remained subdued. This reflects a broader investor shift away from riskier, illiquid ventures towards safer, more capital-efficient opportunities, highlighting that uncertainty in macroeconomic conditions and fundraising environments continues to weigh on early- stage innovation in Europe’s cleantech sector.

EU27 Cleantech Seed, Series A, Series B and Growth investment, 2020 – H1’25

Sources: Cleantech for Europe

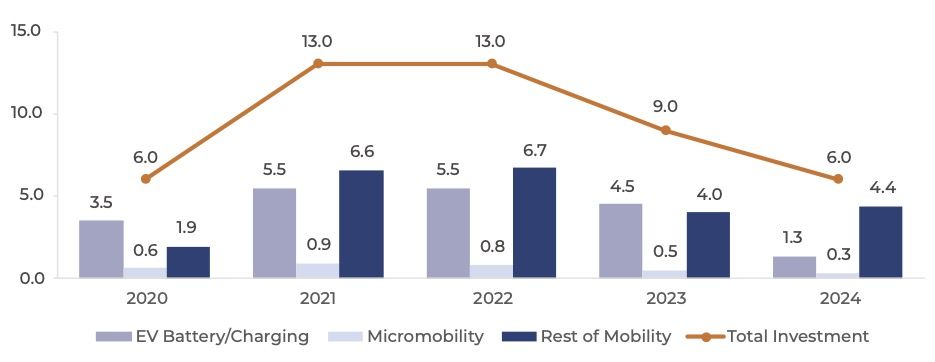

VC Investment in European Mobility Startups by Segment ($ Bn), 2020 – 24

Delays and Cancellations in European Battery Projects

Investor sentiment has turned cautious, intensifying scrutiny on early-stage battery ventures. Cost overruns and execution risks have shifted institutional preference towards projects backed by experienced industrial partners with proven track records and financial strength.

This shift is already reshaping the market. Volkswagen’s battery subsidiary, PowerCo, has scaled back plans for its Salzgitter plant, cutting from two production lines to one amid broader market headwinds and increasing caution towards large-scale battery investments. Similarly, French startup Verkor faced difficulties in raising €1.3 billion for its Dunkirk gigafactory, with investors insisting on detailed audits and validation of its technology and production plans, highlighting the new standard of diligence now shaping the funding landscape.

Even established joint ventures are feeling the pressure. ACC, a collaboration between Stellantis, Mercedes-Benz, and TotalEnergies (through its subsidiary Saft), has paused expansion plans for its battery plants in Germany and Italy. Once a cornerstone of Europe’s battery strategy, ACC is now reassessing its technology roadmap and exploring lower-cost chemistries in response to the prevailing tough market conditions.

These developments reflect the broader challenges that emerged in the battery sector during 2024, when a notable slowdown in EV sales growth—particularly in Europe— prompted a reassessment of expansion plans. With demand plateauing amid high vehicle prices, insufficient charging infrastructure, and uncertain policy signals, many companies viewed the market outlook with caution. As a result, several gigafactory projects were delayed or cancelled, as firms responded to softer demand and reassessed the feasibility of rapid capacity ramp-up. The combination of weaker-than-expected growth and tightening financial conditions marked a turning point, forcing the industry to adopt a more measured approach to scaling battery production.

Indicative List of Projects Cancelled or Put on Hold in Europe

| Plant Location | Company | Country | Capacity (GWh) |

|---|---|---|---|

| Uberhern, Lauchhammer, Germany | Svolt | China | 40 |

| Mo i Rana, Norway | Freyr | Norway | 83 |

| Kaiserslautern, Germany | ACC | France | TBD |

| Scarmagno, RomanoCanavese, Italy | Italvolt | Italy | 45 |

| Termoli, Italy | ACC | France | 40 |

Asian Dominance in the European Gigafactory Market

Financing greenfield gigafactories in Europe on a non-recourse basis remains a major challenge, particularly as much of the region’s existing battery manufacturing capacity and project pipeline is already dominated by established Asian players. Companies such as China’s CATL, Japan’s AESC Group, and South Korea’s LGES, Samsung SDI, and SK On have secured a strong foothold in the European market. Their early entry, technical expertise, and proven execution capabilities have positioned them as preferred partners for both automakers and investors, reinforcing Asia’s influence over Europe’s EV battery supply chain.

While Europe has announced ambitious plans to scale domestic gigafactory capacity, many of these projects are still classified as medium- or high-risk. According to analysis by Transport & Environment (“T&E”), a significant portion of European-led initiatives lack final investment decisions, stable financing, or regulatory clarity. In contrast, Asian-led projects are typically classed as low risk, with many already operational or nearing completion. This disparity gives Asian firms a significant head start and creates a structural opening for them to capture greater market share.

Battery Investments from European Companies more at Risk than Foreign Competitors

Battery Investments from European Companies more at Risk than Foreign Competitors

Combined Capacity of European Gigafactories (Currently operating ond potential) by 2030

| Risk Category | Capacity (GWh) | Investment (€ million) |

|---|---|---|

| Low | 390 | 39,000 |

| Medium | 630 | 48,000 |

| High | 1,430 | 108,000 |

| Total | 390 | 39,000 |

Source: Transport & Environment

In this context, Asian battery manufacturers are consolidating their presence through a dual approach: entering strategic partnerships with European firms while also undertaking independent greenfield investments. A notable example is Slovakian startup InoBat, which secured a 25% stake investment from China’s Gotion High- Tech through a joint venture to co-develop European gigafactories. Gotion’s involvement was pivotal in enabling InoBat to raise €100 million in Series C funding, with investors citing the partnership as critical to validating the company’s production potential. Another major development is the joint venture between Stellantis and CATL, which will see up to €4.1 billion invested in a 50GWh LFP battery plant in Zaragoza, Spain, with production expected to begin in 2026.

Alongside these partnerships, Chinese players are increasingly pursuing standalone projects to serve Europe’s EV battery demand directly. For instance, China Aviation Lithium Battery (“CALB”) has committed €2 billion to establish its first European gigafactory in Portugal, targeting 15GWh of annual capacity by 2027. Similarly, CATL and EVE Energy are advancing their own projects across the continent.

Through this two-pronged strategy— combining partnerships that provide European credibility with independent investments that ensure long-term control—Asian firms are strengthening their competitive edge in the region. By leveraging their technological expertise, financial strength, and proven ability to execute at scale, they are poised to lead the next wave of European gigafactory expansion between 2025 and 2030.

Diversifying Offtake Contracts to Avoid Concentration Risk

The volatility of the EV sector has underscored the risks of concentrating gigafactory output in a single end market. While early growth in Europe’s battery industry was largely anchored by long-term supply agreements with major automakers, this model has revealed vulnerabilities when demand patterns shift. Reliance on one sector leaves manufacturers exposed to cyclical downturns, regulatory changes, and evolving consumer preferences.

In response to the evolving market dynamics, new gigafactory projects are increasingly adopting more diversified offtake strategies. Developers and investors are broadening their focus to include a wider range of end- use markets, such as energy storage systems, grid-scale applications, and industrial sectors. By distributing exposure across multiple demand drivers, manufacturers can mitigate concentration risk and enhance the resilience of their business models.

A case in point is Volklec, a UK-based startup backed by former Britishvolt investors. In collaboration with China’s Far East Battery, Volklec is pursuing a phased development strategy for its £1 billion gigafactory, with a targeted capacity of 10GWh by 2030, by initially importing battery cells to generate early revenue. Its target sectors span e-bikes and energy storage, with longer-term plans to enter automotive, aerospace, and marine markets—illustrating a deliberate move towards demand diversification.

Additionally, newer projects are embedding greater flexibility into offtake contracts, incorporating features such as adjustable volumes, renegotiation provisions, and milestone-based commitments. Supply is also being distributed across a wider pool of smaller customers to enhance resilience against sector-specific downturns or client attrition. This evolving approach reflects a broader recognition of the need for balanced and adaptive growth strategies in the battery manufacturing sector.

Emergence of Alternative Business Models

Although strategic partnerships with established Asian players have become the preferred path for scaling projects, several European battery manufacturers continue to pursue standalone strategies, opting to scale operations without such alliances. For example, France’s Verkor is moving ahead with a €3 billion gigafactory in Dunkirk, backed by Renault. In the near term, the company is focused on meeting Renault’s delivery targets to strengthen trust among other automakers, reflecting the industry’s increasing emphasis on production reliability.

Meanwhile, UK-based Ilika is taking a different approach, opting for an asset-light licensing model for its solid-state battery technology. Rather than building its own factories, it plans to license battery designs to established manufacturers, with test cells set for delivery to 17 partners—including Tata Agratas in 2025. Additionally, a licensing deal with Cirtec Medical will enable production of miniature batteries for medical devices starting next year.

These examples illustrate how European players are responding to market challenges by adopting alternative business models— ranging from client-aligned partnerships to IP-driven licensing strategies. As the sector continues to evolve, more companies are likely to adopt similar approaches.